Asset Allocation

Posted

on Monday, July 13, 2020

in

Wealth Management

If you’re like most investors, you have different types of assets. Because one type of asset behaves differently from another in terms of risk and return, it’s important to strategically plan what portion of your investment portfolio you’ll dedicate to each type of asset.

Why is this important?

Proper asset allocation can provide the necessary diversification to help mitigate your investment portfolio from falling victim to the market’s short-term volatility. It’s easier to go about diversifying your portfolio when you first decide what percentage of each type of asset you’ll hold. All investors are unique, and since there are infinite ways to allocate your assets, your portfolio can be unique too. Your time horizon and your risk-tolerance level have an impact on how you decide to allocate your assets.

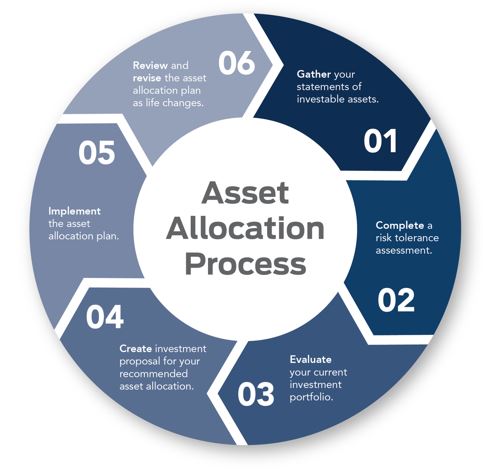

Where do I begin?

With so many different asset categories, there are multiple ways to divide your portfolio. The goals you want to achieve also are important to consider. At First Point Wealth Management, we have the expertise to guide you through these important decisions. Through a risktolerance assessment or completing a thorough financial plan, we are here to help you.

Asset allocation does not ensure a profit or protect against a loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

First Point Wealth Management is not a registered broker/dealer and is not affiliated with LPL Financial. The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of the following state:

AZ, CA, CO, FL, GA, IA, IL, IN, KS, KY, MA, MD, MI, MN, MO, NC, NE, NM, NY, OR, PA, SC, SD, TX, VA, WA, WI

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First National Bank and First Point Wealth Management are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using First Point Wealth Management, and may also be employees of First National Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, First National Bank or First Point Wealth Management. Securities and insurance offered through LPL or its affiliates are: