Five Ways to Spring Clean Your Portfolio

Posted

on Monday, April 10, 2017

in

Wealth Management

Spring cleaning is all about sprucing up and getting a fresh start. It is an activity that applies not only to your home and office, but to your financial holdings as well. Here are five tips to help you renew and refresh your investment outlook for 2017.

- Assess the big picture. Before filing away your year-end 2016 account statements, gather them together to get a full picture of your overall account holdings. Try to categorize your portfolio by account type (e.g., 401(k), IRA, brokerage accounts, etc.) and by asset class (large-cap stocks, small-cap stocks, etc.).1 This exercise should give you a snapshot of your overall holdings and help you identify where gaps or redundancies may exist.

- Review your goals. Most of us have a number of financial goals—for example, having adequate savings for retirement or children's college costs, or something shorter term such as a vacation or a down payment on a home. As you look over your financial accounts, what story do they tell? Are your investments consistent with your goals? Are they moving you forward in the right direction?

- Consider performance. Many account statements compare the performance of your holdings to a benchmark, which is typically an index such as the S&P 500. Look at performance over both the long and short term to identify potential changes you might want to make to your portfolio components. Also look at trends in an investment's price. Failure to get out of a losing position in a timely manner may be an important reason why your portfolio underperforms.

- Check for portfolio drift. Does your current asset allocation—the mix of securities in your investment portfolio—still match your risk tolerance and time horizon?2 Over time, any portfolio allocation is subject to drift—that is, when one asset class outperforms another, causing a shift in the makeup of the account and exposing you to risk you might not want to take.

- Rebalance, if needed. Once you have determined that your portfolio has indeed drifted and that "rebalancing" is needed there are several ways to do it.3 One is to sell investments in the overweighted asset classes to buy investments in an underweighted asset class. Another, simpler method, is to use new money to increase the amount in underweighted assets. If you are rebalancing within your 401(k), you might change your allocation for future contributions. If you have multiple investment accounts, figure out how your money is allocated among assets in each account and then across all accounts. In any case, consult your financial advisor or accountant to discuss the tax implications of your decisions before making any changes.

First Point Wealth Management is here to help you with all of your needs, contact us today!

Information is provided by Ric S. Nelson, CFP©, Investment Representative at First Point Wealth Management. This communication is not intended to be financial advice and should not be treated as such. Each individual's situation is different. You should contact your financial professional to discuss your personal situation.

1 Investing in stocks involves risks, including loss of principal. Securities of smaller companies may be more volatile than those of larger companies. The illiquidity of the small-cap market may adversely affect the value of these investments.

2 Asset allocation does not assure a profit or protect against a loss.

3 Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.

First Point Wealth Management is not a registered broker/dealer and is not affiliated with LPL Financial. The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of the following state:

AZ, CA, CO, FL, GA, IA, IL, IN, KS, KY, MA, MD, MI, MN, MO, NC, NE, NM, NY, OR, PA, SC, SD, TX, VA, WA, WI

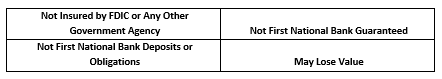

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First National Bank and First Point Wealth Management are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using First Point Wealth Management, and may also be employees of First National Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, First National Bank or First Point Wealth Management. Securities and insurance offered through LPL or its affiliates are: